Got Multiple Old Pensions? Get Your Free, No Obligation Pension Consolidation Check

Unlock simplicity for your retirement savings. Callum can help you to discover how combining your scattered pension pots can bring clarity and control to your financial future.

Are These Pension Worries Keeping You Awake at Night?

Lost Track of Multiple Old Workplace Pensions?

Managing several separate pension pots can be an overwhelming and confusing burden.

Missing Out on Potential Growth & Lower Fees?

Scattered pensions may not be working in harmony, potentially leading to missed opportunities and higher overall charges.

Lacking a Clear, Cohesive Retirement Picture?

Without a unified view, understanding your complete retirement income and planning your future can feel uncertain.

How The Consolidation Check Works in 3 Simple Steps...

Text with the team to get booked in

Once you submit your details. Callum’s team will be in touch to answer some initial questions and get a rough sense of your current situation. Before booking you into Callum’s diary.

Callum will answer your questions

During your consolidation check you can quiz Callum on all your burning questions and get clarity on the state of your finances ahead of your retirement.

Discuss next steps with zero pressure

At the end of the consolidation check, Callum will offer up some next steps and set the date for a second more in-depth strategy meeting should you wish.

Why Choose Callum For Your Pension Consolidation?

Finally Understand Your Consolidated Pension, Simply.

Get straightforward, jargon-free explanations that clarify your combined pension options and what they mean for your future.

Receive Compassionate, Honest Consolidation Guidance.

Benefit from Callum's relationship-driven approach, focusing on your unique situation without pressure or hard selling tactics.

See What's Truly Possible With Your Unified Pensions.

Explore tailored paths for your consolidated pension, understanding its potential to support your long-term retirement goals.

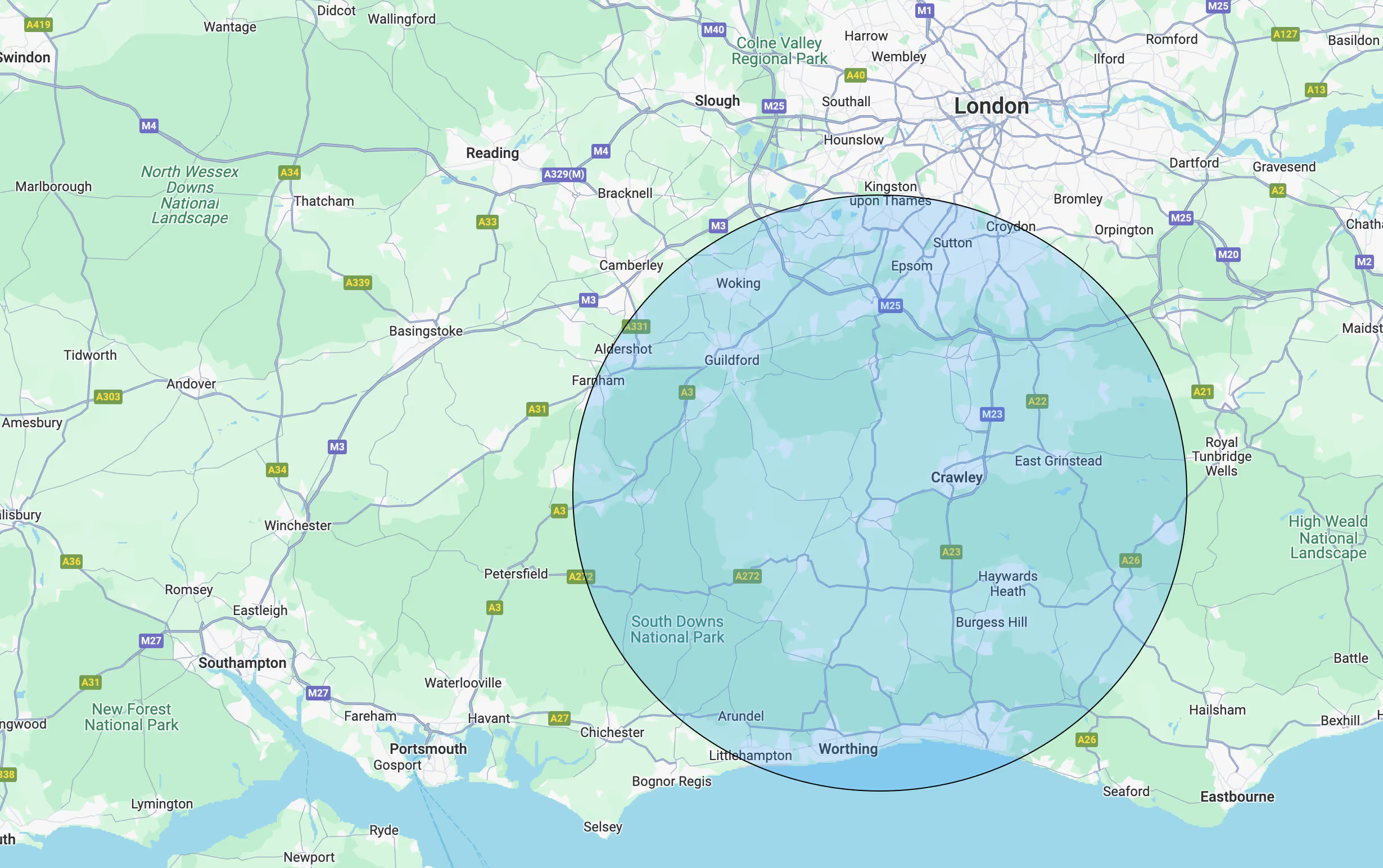

Meet Your Local Pension Consolidation Expert From Crawley, West Sussex

Hi, I’m Callum Healey.

A fully licensed financial planner and managing director at Apex Financial Planning in Crawley, part of the Quilter Financial Planning Network.

My mission is to give residents in the south east, UK more control over their future with clear, jargon-free advice.

Too many financial planning firms overcomplicate things.

Relying on jargon and complex language to explain your finances.

I prefer to keep it simple, offering straightforward, face-to-face guidance in plain English.

Outside of work, I’m a semi-pro boxer and soon-to-be dad. Roles that teach discipline, planning, and commitment.

Exactly what I bring to every client relationship.

Because when it comes to your future, you deserve someone truly in your corner!

Chat With Callum Over the phone or face to face

The consolidation check is available to anyone within 50 miles of Apex Financial Planning’s HQ in Crawley, West Sussex. Allowing Callum to offer a face to face meeting to everyone who applies.

Frequently Asked Questions around Pension Consolidation

I'd be happy to take a look at your pensions. I can estimate how much regular income or cash lump sums they might provide when you retire.

I can work with you to estimate your living costs when retired.

We can look at different scenarios to figure out how much money you'll likely need to maintain your lifestyle. Then we'll see if your pensions cover that or fall short.

I can explain when and how you can access your retirement money. Including looking at: pension ages, taking cash sums, setting up income withdrawals, purchasing annuities, etc.

We'll look at what amounts will be available and when, and decide how best to draw your pensions.

I'm happy to look over your current pensions, the funds they invest in, their fees and growth so far. I can let you know if they are tracking similarly to the wider market. Then give suggestions if changes may be needed to better target your goals.

I can provide specifics on when and how you can access money from each of your current pensions. Including any preserved benefits, deferred schemes etc.

We can also talk about some best practices when it comes to accessing your pension pot(s).

I'd be glad to offer a free second look at your situation. I'm happy to go over your goals, investments, fees and other key items. I can provide feedback and suggest any recommendations as a second set of eyes.

Sure - combining old pensions often makes sense. I can look at each one, the investments, fees and growth. Then explain your options to consolidate them, like pension transfers or self-directed accounts, and recommend the simplest approach to maximise your pensions.

Text with the team to get booked in

Once you submit your details. Callum’s team will be in touch to answer some initial questions and get a rough sense of your current situation. Before booking you into Callum’s diary.

Callum will answer your questions

During your pension health check you can quiz Callum on all your burning questions and get clarity on the state of your finances ahead of your retirement.

Discuss next steps with zero pressure

At the end of the health check, Callum will offer up some next steps and set the date for a second more in-depth strategy meeting should you wish.